The Monty Python reunion is almost over, the reviews are in (including this equivocal notice in the NS from Mark Lawson) and the commemorative concert Blu-Ray boxed-set and accompanying souvenir lumberjack shirts and tins of Spam are doubtless being readied for the pre-Christmas shelves. How to silence your Python pangs in the mean time when you’ve already watched Monty Python and the Holy Grail, Monty Python’s Life of Brian and Monty Python’s The Meaning of Life and you feel that now it’s time for something completely different? Well, moderately different anyway. Plug your longing, then, with this handy mini-festival of the best of the Python members’ extra-curricular cinematic activities:

John Cleese

Conventional wisdom would have it that, Fawlty Towers aside, A Fish Called Wanda was John Cleese’s post-Python peak. And that movie is certainly a slick, punchy piece of work, notable both for its cosy British nastiness and its transformation of this garden rake of a man into a romantic hero. But for an undiluted shot of Cleese’s livid energy, try Clockwise, the simple but comically agonising 1986 tale (written by Michael Frayn) of one punctiliously punctual headmaster’s attempts to reach a conference on time. Key line: “It’s not the despair. I can take the despair. It’s the hope I can’t stand…”

Eric Idle

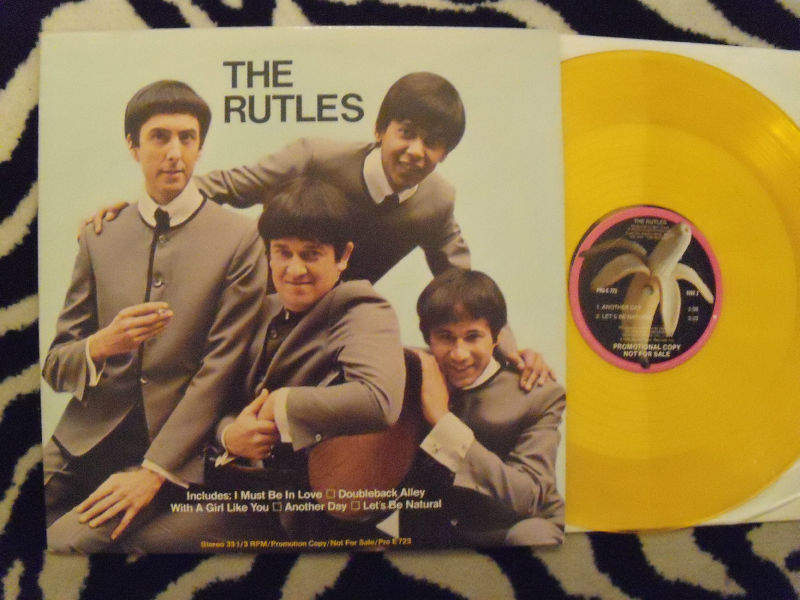

He hit paydirt—or further paydirt—with his Holy Grail musical, Spamalot, but Eric Idle has never been smarter or funnier outside Python than he is in All You Need is Cash, a laugh-a-second 1978 mockumentary about the Rutles, aka the Prefab Four, the popular beat combo (Dirk, Barry, Stig and Nasty) who bear a remarkable resemblance to the Beatles. The Rutles, born out of Idle’s TV show Rutland Weekend Television, are both loving homage and prickly parody; their songs are immaculate pastiches as well as sparkling compositions in their own right. Idle, playing several roles in All You Need is Cash (including the McCartney-like Dirk and the ingratiating host of the documentary), is at his prissy, bristling best.

Michael Palin

Palin is not only the sprightliest member of the troupe, he is also the one clutched most tightly to the public bosom. Travel documentaries, frank and jaunty diaries, the matchless Ripping Yarns TV series (written with Terry Jones), endearing and vulnerable turns in A Fish Called Wanda and Alan Bleasdale’s Channel 4 series GBH, not to mention Palin’s sheer bloody niceness—all these things have contributed to his spotless persona. That’s why I’m prescribing as an antidote his cameo turn as a dapper, smiling torturer in fellow Python Terry Gilliam’s Brazil. No one else had exploited or even identified Palin’s capacity for the sinister (and, no, the Spanish Inquisition sketch doesn’t count) so it was both chilling and mildly revelatory to see him in that context.

Terry Jones

The two Terrys (who shared directing credits on Holy Grail before Jones got sole credit on the remaining Python pictures) were alone among the team in becoming established filmmakers in their own right. Its view of the sex industry may be delusional in its softness but I retain a lingering fondness for Jones’s naughty-but-nice 1987 comedy Personal Services. The film has a winning performance by Julie Walters as a suburban madam (based on Cynthia Payne), a gender-oriented surprise that predates The Crying Game and a delightful climactic courtroom scene in which Walters surveys those assembled to condemn her and realises that most of the men are clients of hers.

Terry Gilliam

The only member whose film career has eclipsed anything he did as part of Python is Terry Gilliam, who went on to become a visionary, if latterly infuriating, filmmaker. Brazil was his masterpiece, but his 1981 comic adventure Time Bandits is as near to that status as makes no difference. As well as featuring cameos from Cleese (as a sneaky, what-ho Robin Hood) and Palin, it fuses Pythonesque eccentricity with a properly thrilling time-travel plot and a robust sense of wonder. The unsentimental ending cheers the soul.

Graham Chapman

The “one” in the “One Down, Five to Go” title given to the Python’s reunion shows, Chapman died in 1989 but lives on, animated and re-animated, in the recent inventive documentary A Liar’s Autobiography: The Untrue Story of Monty Python’s Graham Chapman (co-directed by Terry Jones’s son, Bill Jones).