Among Conservatives, George Osborne is known as “the submarine” for his habit of surfacing only for set-piece events such as the Budget and retreating under water at the first sign of trouble (for similar reasons, Gordon Brown was nicknamed “Macavity”, after the cat who wasn’t there).

Unfortunately for the Chancellor, on those occasions when he does appear, it is invariably to deliver bad news. When Osborne presents his autumn statement to the House of Commons on 5 December, he will again be forced to announce that growth is lower than expected and borrowing higher.

In March, when the Office for Budget Responsibility (OBR), the independent fiscal watchdog established by Osborne, last published forecasts, it predicted that Britain would avoid a double-dip recession and the economy would grow by 0.8 per cent this year. Yet, a month later, the UK returned to recession (the only G20 country, with the exception of Italy, to have done so) and went on to suffer a third consecutive quarter of contraction. Independent forecasters now expect the economy to shrink by 0.4 per cent this year (see bar chart below).

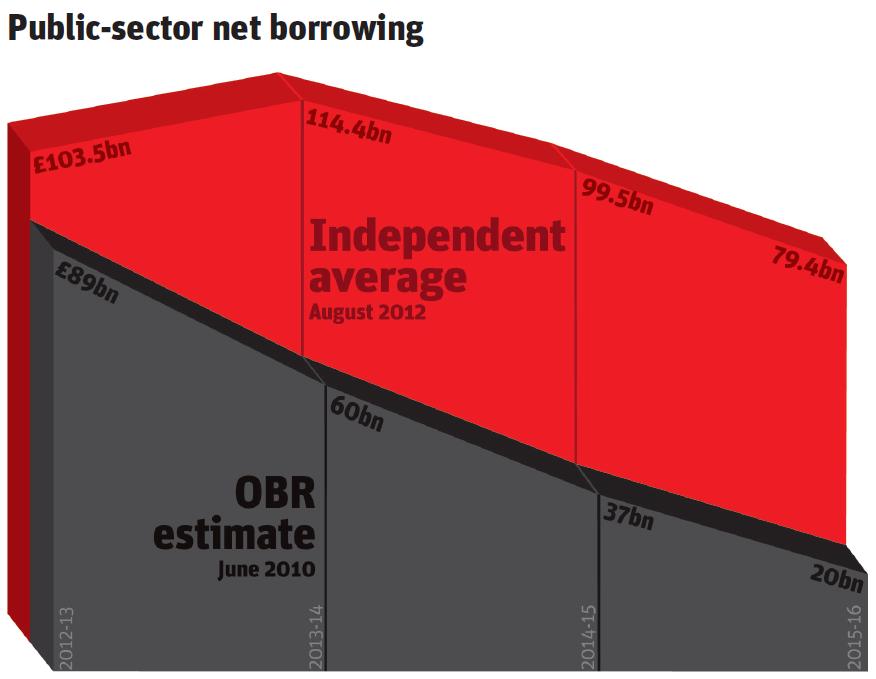

As a result, Osborne’s deficit reduction plan, which was premised on a steady recovery, has been thrown off course. The Chancellor is fond of boasting that he has reduced the deficit by a quarter (from £159bn in 2009-2010 to £119bn in 2011-2012) since taking office, but the disappearance of growth makes this trend unlikely to continue. Borrowing so far this year is 22 per cent (£10.6bn) higher than in the same period last year and forecasters expect the government to miss its deficit target for 2012 (£120bn) by as much as £30bn. In total, it is predicted that the coalition will borrow £190.8bn more than originally intended (see graph below). At the time of his emergency Budget in June 2010, Osborne declared that “unless we deal with our debts there will be no growth”. But he has learned that the reverse is true – unless you stimulate growth, you can’t deal with your debts.

Golden rule

The parlous state of the public finances makes it likely that Osborne will announce the abandonment of his golden debt rule in the autumn statement. The Chancellor’s “fiscal mandate” requires public-sector debt to be falling as a share of GDP by 2015-2016, an aim that appears increasingly unachievable. In March, the OBR forecast that debt would fall from 76.3 per cent in 2014-2015 to 76 per cent in 2015-2016, but the IMF has more recently predicted that it will rise from 78.8 per cent to 79.8 per cent.

Although Osborne could announce billions more in spending cuts and tax rises in an attempt to meet his target, even he recognises that it would be both politically and economically reckless to do so. Instead, he will partly accept the Keynesian argument that debt reduction must not be given priority over growth.

The governor of the Bank of England, Mervyn King, with whom Osborne has an unspoken alliance, has prepared the ground for the Chancellor by stating that it would be “acceptable” to abandon the target if the economy continues to struggle. But even though Osborne, an arch-pragmatist, accepts such logic, the decision will cause him no small pain. He will, indisputably, have failed on his own terms.